Table of Content

He has been revealed on well-known personal finance sites like Bankrate, Credit Karma, MoneyCrashers, DollarSprout, and extra. TJ has a bachelor's in business administration from Northeastern University. Julius Mansa is a CFO consultant, finance and accounting professor, investor, and U.S. Department of State Fulbright research awardee within the subject of economic expertise. He educates business students on matters in accounting and company finance.

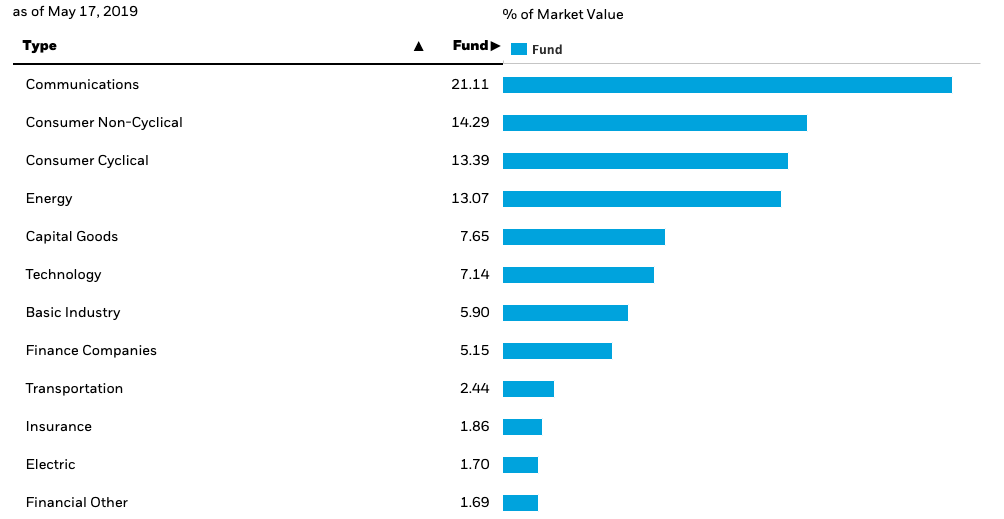

Corporate debt comprises half the fund, while the other half is cut up between U.S. government debt and securitized debt. VCSH’s portfolio at present holds almost 2,400 bonds with an average duration of 2.eight years and a median coupon price of 3.2%. The majority carry ratings in the A to BBB zone, permitting for slightly larger yields than higher-rated AA, AAA and government bonds would provide. The fund owns short-term, tax-exempt municipal bonds issued by state and local governments. The fund seeks returns aligned with the Bloomberg Managed Money Municipal Short-Term Index benchmark. The iShares Interest Rate Hedged High Yield Bond ETF enlists a method much like LQDI, its corporate bond sibling.

Investing For Beginners: The 6 Greatest Investments To Get Started

The primary profit is not that you’ll be incomes high returns—it’s that you’ll be earning regular and reliable returns. Most traders wish to develop a passive earnings on their earnings and have money often entering their financial institution accounts, even when considered one of their investments fails. While inventory ETFs are typically cheaper than mutual funds, the reverse is true with bonds. Bond mutual funds are usually cheaper than an actively managed bond ETF. ETFs are easy to buy, so you’re able to diversify your choice of bond ETFs with little problem. For occasion, you could purchase shares in both a short-term bond ETF and a long-term bond ETF, or a government bond ETF and a corporate bond ETF.

BulletShares funds are unique in that they distribute principal back to buyers once the scheduled maturity date is reached. BSCN's maturity date is 2023 and can terminate on round Dec. 15, 2023. XMPT allows traders to entry the municipal bond market by replicating as closely as potential the value and efficiency of the S-Network Municipal Bond Closed-End Fund Index. The benchmark tracks the efficiency of the U.S.-listed closed-end funds that purchase securities within the U.S.-dollar-denominated tax-exempt market.

Ishares Iboxx $ Investment Grade Company Bond Etf (lqd)

Bonds in classes such as high-yield, floating-rate, and short-term are used only for a small portion of the general portfolio. Their utilization depends significantly on your funding circumstances in addition to broader market conditions. Bond ETFs normally play a crucial role within the asset allocation of a well-built portfolio. Your allocation between stocks and bonds primarily is determined by your objectives and threat tolerance. ZFH pays traders a monthly distribution and has an excellent annualized yield.

While XHY isn't as sturdy of a alternative as HYI or NHYB, it remains an excellent Canadian high-yield bond ETF to consider if you're trying to diversify throughout a number of funds. The ETF just isn't rated by National Bank however would probably have an identical ranking to HYI – low to medium. HYI invests in high-yield debt instruments of North American corporations. Next up behind BMO’s ZCS is XSB, offered by way of Blackrock’s iShares lineup.

The latest actual property investing content delivered straight to your inbox. The ETF displays a dividend yield of roughly 5.1% and has an annualized volatility of 12.35%, making it an excellent risk-reward investment. Inflation has at all times been a very frustrating topic among investors as a spike in costs... XGB is a large ETF by means of assets, with an identical level of AUM to ZGB. Although it has a longer monitor document than ZGB, it comes at a much greater MER for the same technique.

Generally, a set revenue ETF may be extra beneficial for day traders and starting investors, whereas a bond mutual fund could additionally be better for long-term investors. Bond ETFs are traded on the stock market so they’re much more liquid than particular person bonds. Individual bonds aren’t traded on the stock market—they’re traded by way of bond brokers. Therefore, it’s unclear simply what quantity of patrons and sellers there are, which can make it tough to purchase or sell at a moment’s notice.

At the end of 2021, fairness funds accounted for 65% of complete funds, and bond funds accounted for 26%. Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, precisely, and from the investor’s perspective. We also respect particular person opinions––they symbolize the unvarnished considering of our people and exacting evaluation of our analysis processes. For instance, a city may issue a municipal bond to pay for infrastructure improvements or different tasks.

The advantage of investing in the ETF as a substitute of the index itself relates to price and affordability. The ETF trades at lower than $290 per share at an expense ratio of merely 0.20%, meaning it’s simply investable. Evidence suggests that inflation has stabilized, which could result in a extra conducive interest rate setting and a reignited stock market.

Etf Dividends

VSB is an excellent option to consider throughout the Canadian short-term bond ETF universe. If you wish to keep your fixed-income danger to a minimal, XSB could additionally be a better option than ZCS. Please note, we could receive affiliate compensation for a number of the links under at no further value to you. This doesn't affect the objectivity of the merchandise we advocate or the scores assigned to them. You can learn my full affiliate disclosure in my phrases and conditions.

Looking for a way to invest in higher-yield corporate bonds, rather than low-yield government bonds? VCIT features debts from top-ranking firms corresponding to Bank of America and Allstate. Investors can have peace of mind understanding that this fund solely aggregates bonds from corporations and blue-chip stocks that are in good standing. For developed nations, bonds issued by the government are typically of the very best high quality, relative to companies operating inside the country. Since these authorities bonds come with a much decrease likelihood of default, they have a tendency to pay a much lower yield than corporate bonds.

It is a passive technique that tracks the FTSE Canada Short-Term Overall Bond Index. While XSB is throughout the identical short-term class as ZCS, it can be regarded as being decrease threat as a end result of a vital portion of its portfolio is invested in short-term government bonds . This class focuses on bond ETFs that put cash into bonds with a brief maturity date.

The subsequent category targets bond ETFs that put money into investment-grade company bonds. These bonds typically provide a good yield, generally much higher than that of short-term bonds. The primary threat of company bonds is a lower in the high quality of the underlying company, leading to a downgrade of the bond. Bond ETFs are exchange-traded funds that put cash into mounted revenue securities issued by governments, companies, and other entities. This, in turn, builds a diversified portfolio and reduces your threat if a bond issuer defaults. The VanEck Fallen Angel High Yield Bond ETF tracks the worth and performance of the ICE U.S. Fallen Angel High Yield 10% Constrained Index.

The value and yield of an investment in the fund can rise or fall and isn't assured. Investors also can receive back lower than they invested and even undergo a complete loss. Purchase or funding decisions should solely be made on the premise of the information contained in the related gross sales brochure. The info revealed on the Web website doesn't symbolize a proposal nor a request to purchase or sell the products described on the Web site. The data published on the Web site isn't binding and is used solely to offer data. Bond ETFs are advantageous because they’ll provide you with a gentle, reliable return—your earnings won’t be affected by the company’s earnings or by what’s taking place in the market.

No comments:

Post a Comment